The International Energy Agency (IEA) reported that electric vehicle sales doubled in 2021, accounting for 9% of the global car market and estimated that 13% of all new cars sold in 2022 would be electric. By 2030, electric vehicles will represent nearly 30% of all car sales.

The size of the Global Electric Vehicle Market was 287.36 billion in 2021. It is predicted to grow to around $53 trillion by 2050, according to BloombergNEF. Key factors are government backing and policies, including EV charging infrastructure support, addressing climate concerns and a rise in fuel prices.

Electric vehicles (EVs) use electric motors instead of internal combustion engines, which rely on non-renewable fossil fuels and can be fully electric or plug-in hybrid models. According to a study, ninety per cent of cars in the United States must be electric by 2050 to meet climate change mitigation targets the US government committed to in the Paris climate accords. Also signed by 150 other countries, the climate agreement aims to reduce carbon emissions and limit climate change.

The deal, followed by governments considering completely phasing out fossil fuel-powered vehicles in the long run, offering incentives on EV purchases and tax credits to automakers spurred the demand for electric vehicles in Europe and North America. The Inflation Reduction Act (IRA), signed by the Biden-Harris administration in August, considered the most significant climate change legislation in US history, aims to commit to the Paris Agreement and cut emissions by up to 52% by 2030. The Act, which set $370 billion of federal funds for climate and energy, includes tax incentive provisions for both automobile manufacturers and customers and is meant to ramp up EV production on a larger scale. Under the IRA, the automobile batteries must be built in North America for EVs to be eligible for a federal tax credit of up to $7500 on plug-in or hybrid car purchases.

The passing of the Act saw a flurry of automobile companies and battery manufacturers applying for incentives and grants. With a long history of being the automotive capital, Michigan has awarded the most incentives for automobile manufacturers expanding or considering setting up in the state. The Michigan board approved incentive packages worth $715m and $236m for two battery factories estimated to cost $4 billion and bring 4,500 jobs to the state. Ford Motor Co was also awarded a $135m incentive for its $2bn electric vehicle manufacturing expansion plans which are set to create 3200 jobs.

Beneficiaries of the incentives handed out recently include EV component and battery manufacturers, with suppliers of materials for EV batteries, especially lithium and cathode chemical suppliers, also taking a chunk of the handouts. This resulted in a significant rise in new battery factories and battery material supplier expansion announcements in 2022, particularly in Georgia, Michigan, Tennessee and Indiana. Stellantis, an automobile manufacturer, is creating 1400 jobs with its $2.5bn battery manufacturing facility in Kokomo, Indiana. The company was awarded $186.5m in incentives for the new facility.

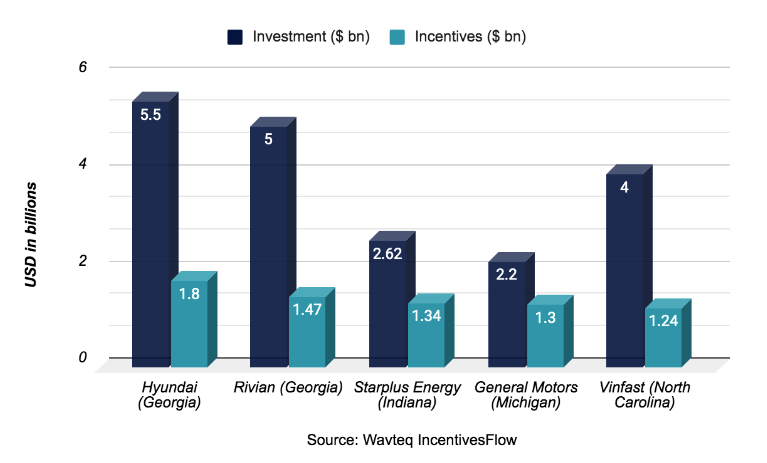

Top five incentive EV automobile and battery manufacturing incentive deals in the USA:

Most incentives were awarded in the form of tax credits over a few years and are performance-based. Companies must commit to job creation goals apart from the massive investments to receive credits or grants. The incentives even enticed companies like Arrival, a UK-based electric van manufacturer which relocated its headquarters and manufacturing operations to the USA. The IRA, which set tax credits of up to $40,000 on purchases of heavy and light-utility clean vehicles weighing over 14,000 pounds, played a major factor in Arrival’s decision.

Local electric grids charge EVs. According to the IEA, one-third of electricity in the US and more than 40% of electricity in the world comes from burning coal, rendering the emission reduction plan by bringing in more EVs on the road futile. Unless entire grids are decarbonised, electric vehicles would not seem to have a marked effect on emissions.

The issue of batteries also poses a question. Lithium batteries have a shelf life. The sheer rise in EV manufacturing will eventually result in battery dumping. Lithium batteries and their materials are hazardous waste and can wreck ecosystems. Recycling lithium batteries is an obvious solution but an expensive process. Recycling lithium batteries must be profitable for companies to expand their capacities sustainably. Currently, there are few companies which do it. Cirba Solutions, investing over $200m to expand its lithium-ion battery recycling facility in Lancaster, Ohio, received a $75m incentive from the US Department of Energy (DOE).

Cirba was one of 20 companies that received a combined $2.8 billion in grants from the DOE as part of the Bipartisan Infrastructure Law to increase domestic manufacturing and reduce the dependence of EV components and materials on other countries.

States could benefit by solving the most significant issue first. To support the influx in demand, governments must provide adequate EV charging infrastructure. The Bipartisan Infrastructure Law plans to distribute a total of $7.5billion in funds to help accelerate the deployment of electric vehicle charging networks and build 500,000 electric vehicle chargers nationwide. If the incentives were also focused on grid decarbonising solutions and improving the tech needed to support battery recycling rather than just boosting domestic EV and battery production, one could foresee the possibility of reaching a zero-emissions future.

Wavteq Institute has curated our latest industry blueprint, which takes a deep-dive into the dynamics of the global electric vehicle market and captures a holistic view of the expanding industry with a focus on the influencing factors, key trends, greenfield investments, M&A activity, key stakeholders and category insights.

Learn more about Wavteq Institute or contact us now to arrange a demo.